Will Dasovich, a popular figure in social media, was diagnosed with cancer at such a young age. In his interview at Philam Life’s launch of it’s new product, Will said “It was a huge scare for me. Illnesses like cancer is supposed to come when you’re old and you’ve lived life to the fullest, not when you’re just starting to have fun. It was such a wakeup call for me to start thinking and preparing for my future, now that I’ve been given a second lease in life.”

No matter how painful it is to think, we can compare critical illnesses like some sort of an unmanned automatic rifle that can shoot at anybody, at anytime, no matter how young or old we are. But there is still one way to live with a peace of mind despite all these. That is by making sure that we have someone to cover us if a critical illness strikes.

Data shows that the average cost of critical illness is about PHP2 million, but when it comes to actual claims made by its customers, Philam Life shared that the average in 2018 is only about PHP350,000. This leaves a big question on where the remaining balance to cover the expense will come from.

In the 2018 Healthy Living Index Study conducted by AIA Group, Philam Life’s Hong Kong-based parent company, the survey revealed that a staggering 78% of Filipinos surveyed are expecting the government to shoulder the cost of treating critical illness.

These numbers will mean more from the point of view of actual people who have battled critical illnesses. Regardless of what age critical illness hits, it wreaks havoc on carefully laid out plans, making the future uncertain for most people, especially those who have a history of illness in their families. This is why Philam Life is committed to create innovative products that help protect Filipinos against the uncertainties of critical illness such as the newly launched AIA Critical Protect 100.

“Most couples our age are probably more concerned about saving up to invest in property or splurging on trips. As brand ambassadors of Philam Life, Solenn and I have become more aware of the importance of life insurance and protecting ourselves from illnesses or untoward events in the future. Investing and saving for the future are important but we’ve come to understand that protection is the most basic need that we have to address first. Living a healthier, longer and better life comes easily when you know you’re protected,” added Nico Bolzico, Philam Life Brand Ambassador.

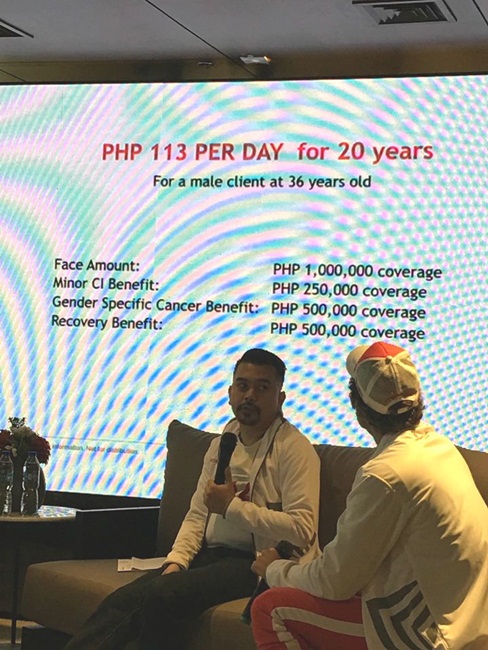

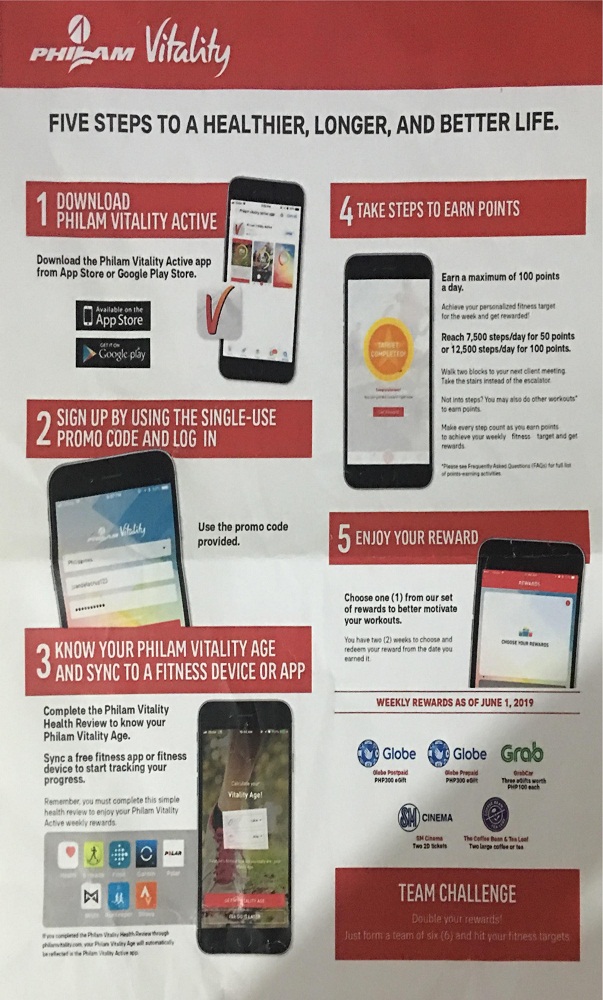

AIA Critical Protect 100 offers comprehensive health and protection benefits from 0-100 years old, offering coverage for up to 100 minor and major illnesses including cancer, heart attack, or stroke. There’s an option to include riders which give increased coverage for gender specific cancers like ovarian or prostate, as well financial benefits during recovery period and plan protection for loved ones. Best of all, the product is powered by Philam Vitality, Philam Life’s game-changing wellness program that helps encourage the right behavior by incentivizing customers with rewards for knowing and improving their health.

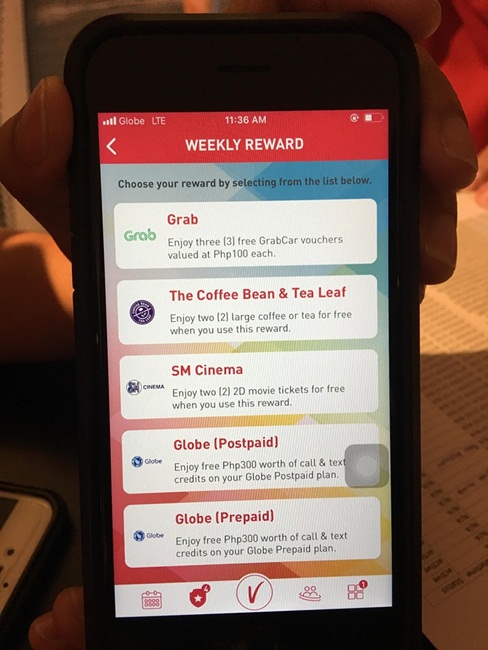

“As a Philam Vitality member, I’m not just protected by life insurance; I’m also rewarded for living a healthier, longer and better life. The program can help prevent the onset of critical illness by challenging and motivating me to meet my weekly fitness target and rewards me for living healthy. This year, Philam Vitality gives stronger motivation to live better with its bigger and bolder rewards that include more instant weekly rewards such as free coffee and cinema tickets, as well as a chance to win a fitness device and a trip to El Nido, Palawan,” said Philam Life Brand Ambassador Raymond Gutierrez.

Philam Vitality’s enhanced weekly rewards include free coffee or tea from The Coffee Bean & Tea Leaf, SM Cinema tickets, GrabCar vouchers, Globe postpaid and prepaid credits, on top of preferential discounts from program partners like Toby’s Sports, Garmin, Gold’s Gym, UFC Gym, Hi-Precision Diagnostics, Makati Medical Center, Enchanted Kingdom, Philippine Airlines, Seda Hotels and SM Cinema.

Find out more about AIA Critical Project 100 and the Philam Vitality by visiting the Philam Life website at philamlife.com, Facebook page at https://www.facebook.com/PhilamLifeAIA/, or contact them through email at [email protected] or landline at (02)528-2000.

Please give mote information regarding the policy for critical protection.