In the past, opening a bank account meant enduring long waits and bringing stacks of personal documents. But those days are long gone, thanks to CIMB Philippines’ groundbreaking initiatives to make banking accessible to all, regardless of gender, appearance, or occupation. I recently had the opportunity to glean some insightful notes from CMIB executives about their mission to democratize banking, savings, investments, and loans.

CIMB’s vision goes beyond traditional banking norms, aiming to empower everyone, from online sellers and market vendors to work-at-home moms, to manage their finances conveniently from the comfort of their homes. No longer constrained by gender biases or appearance expectations, CIMB is paving the way for a more inclusive banking experience.

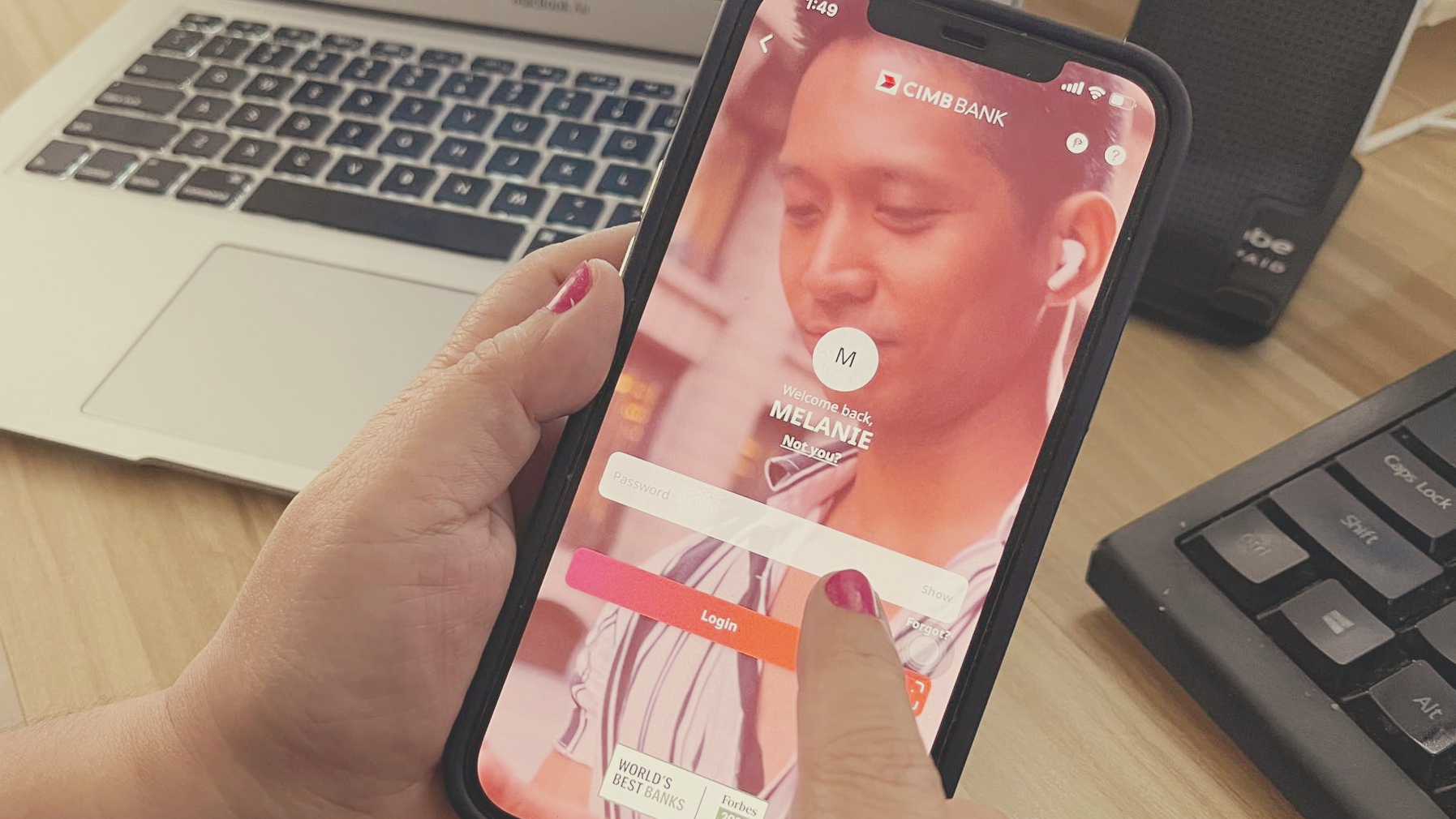

CIMB’s mobile app

And if that isn’t enticing enough, CIMB is turning up the heat this summer with an irresistible offer: the Sunk15sed Promo. From March 1 to 31, 2024, customers have the opportunity to earn up to a whopping 15% per annum interest on their savings, making it one of the most lucrative deals in town.

Existing GSave or UpSave customers as of January 31, 2024, are automatically eligible for this offer. By simply maintaining their account, customers can earn 4% p.a. interest across all balances for the month of March, with no cap. This offer stacks on top of other promotions and the regular base rates, offering a significant boost to savings.

But the rewards don’t stop there. Customers can increase their interest rates even further by meeting certain criteria, such as growing their average daily balance, using their Virtual Debit Card for transactions, or hitting specific spending milestones. With the potential to earn up to 15% p.a. interest, the sky’s the limit for savvy savers.

Bunny Aguilar, CIMB Chief Marketing Officer discussing how CIMB works on making banking inclusive at the recent round-table discussion with members of the media.

With Nikki Constantino, Head of Corporate Communications at CIMB Bank Philippines

Opening a CIMB account is a breeze, taking just 10 minutes via the CIMB mobile app. With only one valid ID required, Filipino citizens aged 18 and above can kickstart their savings journey hassle-free. The CIMB website provides a full list of accepted IDs for reference.

As summer approaches, CIMB invites everyone to join the savings revolution and elevate their financial goals. To dive deeper into this exciting offer, visit cimbbank.com.ph/sunk15sedpromo and embrace a future of inclusive and rewarding banking experiences.