Thinking about financial planning when it’s almost Christmas can be such a boring and are-you-kidding-me topic. Kill-joy, buzzkill. But although the holiday season is undoubtedly magical, filled with joy, laughter, and precious moments with our loved ones, many moms find themselves facing the not-so-magical reality of post-holiday financial stress. So is it possible to build a holiday fund and avoid debt after the holidays?

The best way to create a holiday fund is first, start early and save often. Instead of waiting until the last minute, begin setting aside a small amount of money each month specifically for holiday expenses. Create a dedicated savings account or use a jar at home to collect loose change. Starting early allows you to spread the financial burden over several months, making it more manageable and less likely to impact your regular budget.

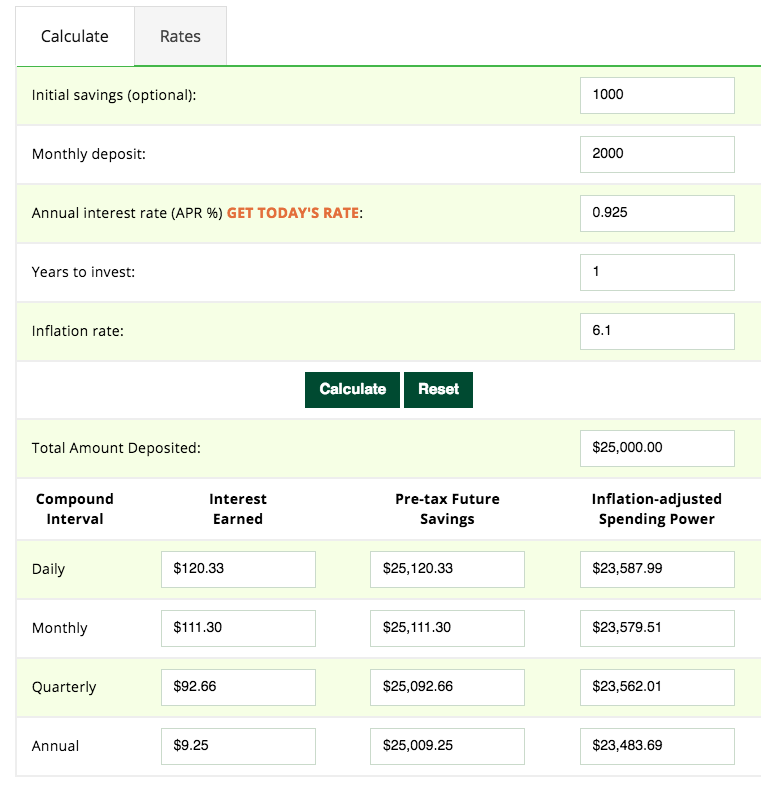

If you have read this piece of advice right now, then you think it might be too late. True, but you can also think of it as an advance preparation for the next year or paying yourself forward. A savings calculator can do wonders*. A P2,000.00 pinch from your wallet monthly will allow a small family to have a nice Christmas feast and a budget for gift giving without the need to get a loan. Or you can even save your 13th month pay next year for the next year or that much needed trip with the family for the next year.

A sample Holiday Fund Savings Calculator (just replace $ with Peso)

Another one of the most effective strategies for avoiding the debt trap is to create a realistic holiday budget. Sit down and list all potential expenses, including gifts, decorations, travel, and special meals. Be honest with yourself about what you can afford and prioritize your spending. Having a clear budget not only helps you stay on track but also prevents impulse purchases that can quickly add up.

Consider embracing the charm of homemade and thoughtful gifts. Handmade crafts, personalized photo albums, or even the gift of your time through services like babysitting can be just as meaningful as store-bought presents. Not only do homemade gifts save money, but they also add a personal touch that’s often more cherished than expensive items.

Lastly, communication is key, especially when it comes to holiday spending. Set realistic expectations with family and friends about gift exchanges and celebrations. Consider suggesting alternative ways of expressing love and appreciation, such as a potluck dinner or announcing gift spending limits. Open and honest communication can help alleviate financial pressure and ensure that everyone enjoys the season without the burden of excessive expenses.

If your holiday plans involve travel, start planning and booking early. Flights and accommodations tend to be more affordable when booked well in advance, and last-minute arrangements often come with a hefty price tag. Planning ahead not only saves money but also allows you to secure the best deals, leaving you with more funds for enjoying the holiday festivities.

Building a holiday fund and avoiding the debt trap requires a combination of early planning, budgeting, and strategic spending. Start saving early, create a realistic budget, and embrace creative ways to boost your holiday fund. The true spirit of the season lies in the joy of spending time with loved ones, not in the material gifts exchanged.

Have a merry-and-stress free holiday!

*inflation rate computation basis